Changing behaviors & COVID-19

As the situation continues to evolve, it’s difficult to imagine just how COVID-19 will affect the world we live in beyond a few days. We can examine how other life-altering global events like Y2K, 9/11, SARS, Zika and other epidemics affected our industry and consumer behavior–not to mention the impact that the last recession had on businesses and consumers.

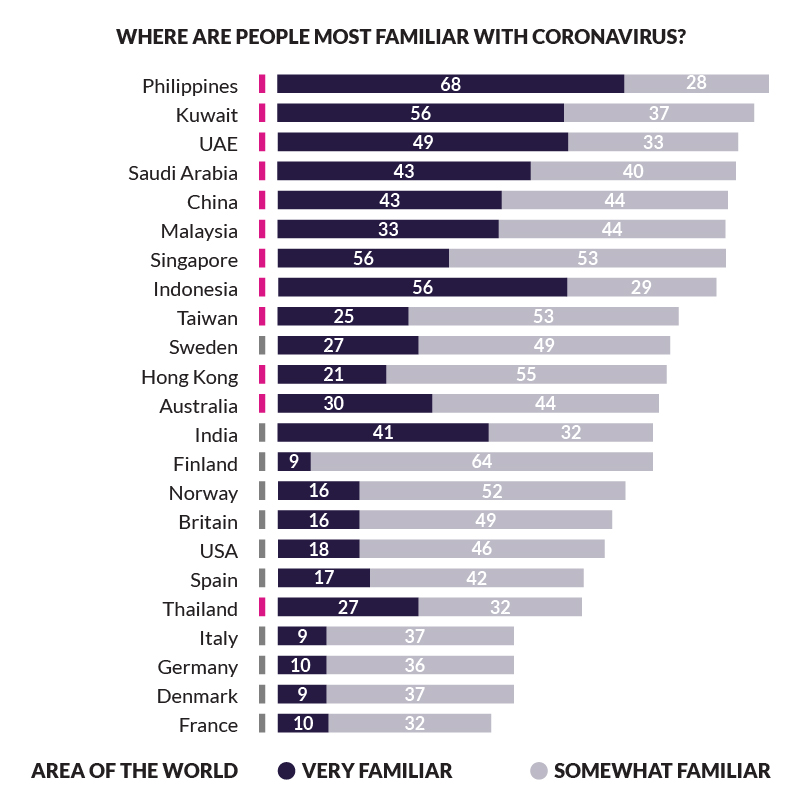

The modern world has never seen a pandemic at this scale, and we’re not even on the other side of it yet. Being that the outbreak began in China, we see that familiarity with coronavirus was higher in Asia and the Middle East than in Europe or the US at the beginning of the year.

Source: You Gov. January 31 – Feb 11, 2020

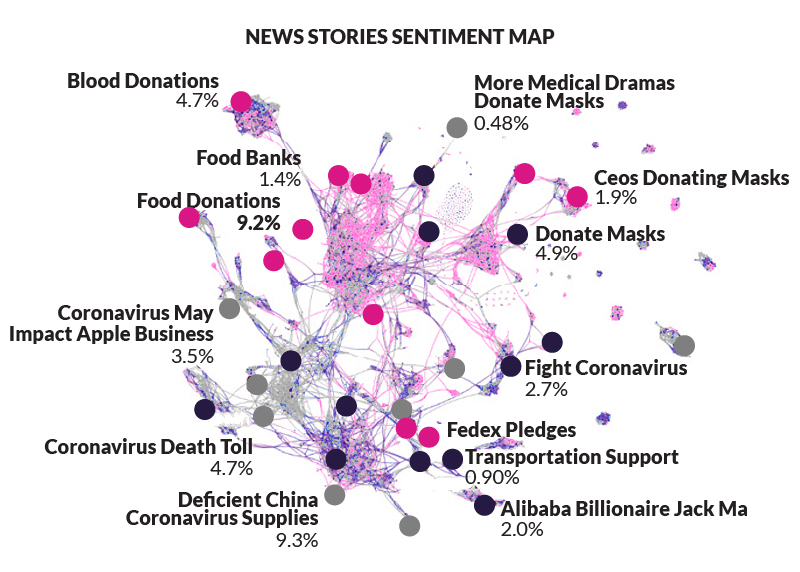

By early March, 24% of Americans were avoiding crowded public spaces and by the end of the month, that number had increased 65%, according to YouGov. This conversation dominated the news cycle, focusing on the spread of the virus, as well as what was being done to limit exposure on both a personal and corporate level, from buying face masks to donations.

Source: Netbase. News story network with 3,110 stories. Colored by Sentiment. Sized by degree. Labeled by clusters. March 2020.

Changes at the grocery store

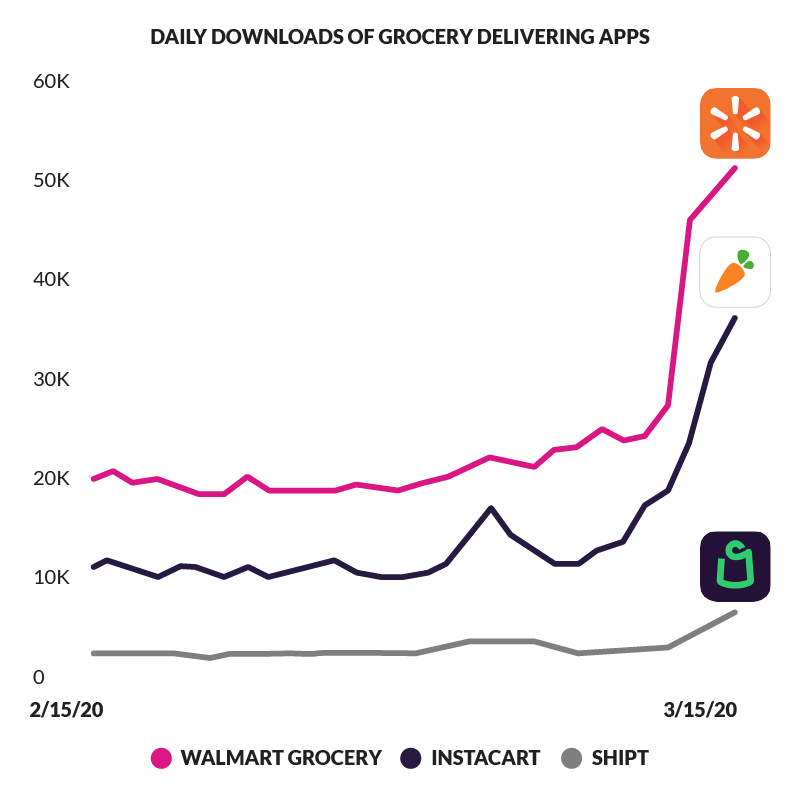

One of the most significant, fundamental changes in consumer behavior that we saw was at the grocery store. With many staples flying off the shelves and more people staying indoors, there was a shift to grocery delivery.

According to Nielsen, just 4% of grocery sales in the United States came online in 2019. Yet, Rakuten Intelligence reports that online order volume from full-assortment grocery merchants rose 210.1% from March 12 through March 15, compared with the same period a year earlier. Americans were more interested than ever in these solutions, and many downloaded grocery delivery apps for the first time.

Source: Apptopia. February 15 – March 15, 2020.

While purchases for essential and safety items saw sharp increases, other categories saw the opposite. Online sales for apparel and footwear retailers fell 37% on March 11 alone, according to Rakuten. Foot traffic to U.S. stores fell 58.4% in the third week of March, according to ShopperTrak, as many cities instituted mandatory quarantines or the shutdown of non-essential businesses. The impact on the future of retail remains unknown, but we do expect the increased reliance on digital to fundamentally change how people shop. Online sales at general merchandise retailers climbed 50% on March 13, according to Rakuten Intelligence, and that is only the beginning.

In March, most shoppers on Amazon looked for toilet paper, face masks, hand sanitizers, and other essentials. There was also an increase in items for working from home, at home sports equipment, and offline entertainment, but most of the in-demand searches returned no items in stock. (Source: Marketplace Pulse) This behavior also led to the removal of many sellers from the platform due to price gauging.

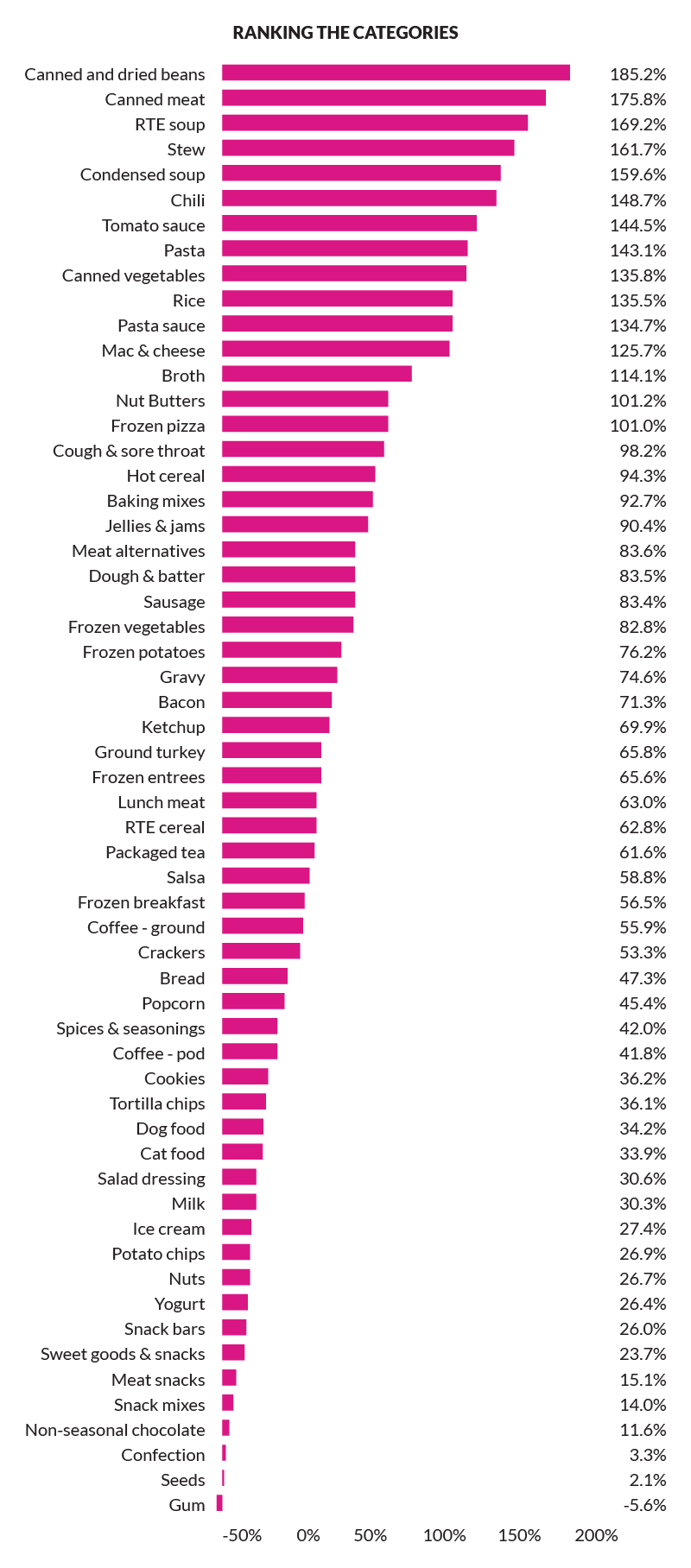

It begs the question of what repercussions these new behaviors will have on the shopping experience. For example, impulse buys and new product trials are usually driven from end cap promotions or while waiting in line at the store. If shoppers no longer have those in-store interactions, then brands will need to think of new ways to engage them. We saw an uptick in many household staples as people prepared to stay home and prepare food at home during quarantine such as canned foods, soups and pastas.

At the bottom of this list lies gum, which is often one of those impulse buys shoppers tend to grab while waiting in line.

Source: The Nielsen Co.

This means that digital experience will need to be adjusted to account for new behaviors. As people begin ordering their groceries more and more online in addition to other businesses offering delivery, we may see that they become an expectation of service.

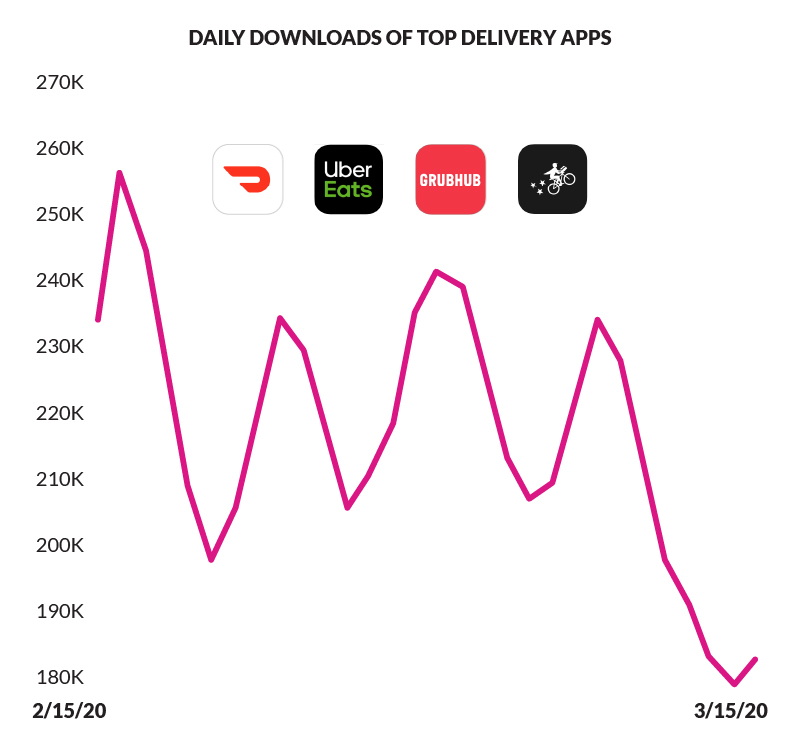

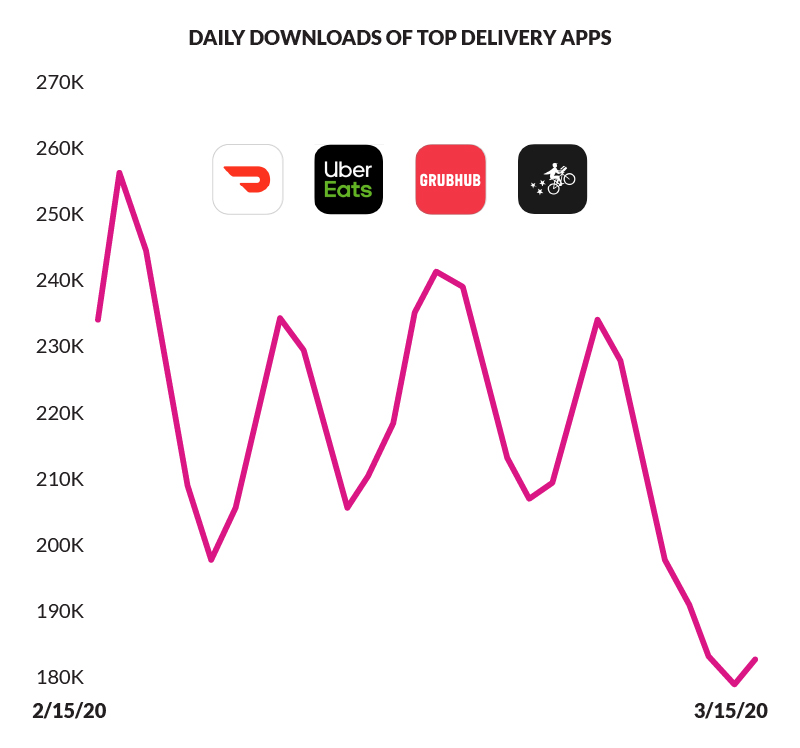

Changes in food delivery

During March, search interest for “take out” increased 285% across the US, and interest for “is food delivery safe” increased 650% (Source: Google Trends). Naturally, with people staying at home, we have seen a clear need for food delivery increase, but a more substantial concern is safety. Therefore, when developing new strategies, it’s essential to keep in mind that at the core of the pandemic is health and safety.

Source: Apptopia. February 15 – March 15, 2020.

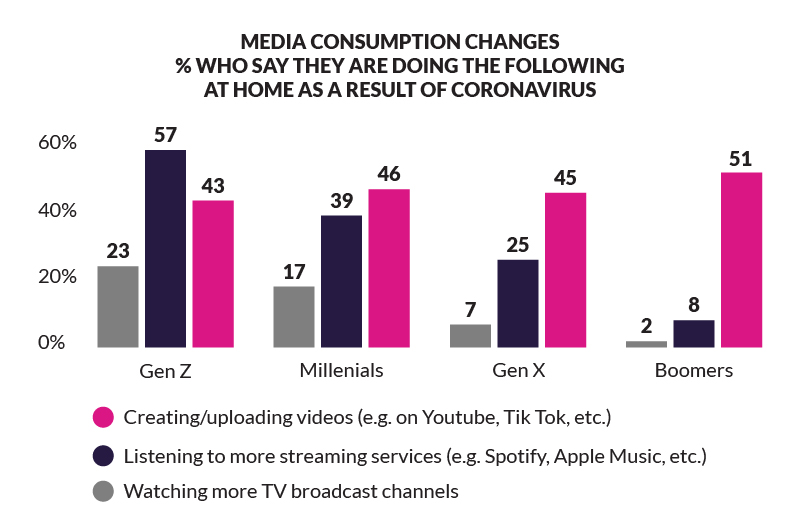

Changes in media consumption

A GlobalWebIndex survey highlighted some of the adjustments to US routines as a result of the quarantine:

- 95% of consumers say they’re now spending more time on in-home media consumption activities

- 2 in 3 are spending more time watching news coverage (half of whom say they are spending significantly more time on it)

- Gen Z are 7X as likely as boomers to report increased usage of music-streaming services (over 10X as likely to be creating and uploading videos)

- Boomers are the most likely to be watching more TV on broadcast channels

As more Americans stay home, the more reliant they are on screens for information, entertainment, work and connection. While a lot of advertising was pulled back to assess the situation, once brands decide it’s time for them to reenter the space, it will most likely be focused on OTT, mobile and digital ads.

Source: Global Text Index. Base: 12, 845 internet users aged 16 – 64. March 16 – 20, 2020.

What about streaming?

- According to Hulu, binge-viewing — that is, watching three or more episodes in the same session — has grown more than 25% over the first two weeks of March vs. the two weeks prior

- Netflix had the biggest share of streaming minutes during the last week of March with 29%, followed by YouTube at 20%, Hulu at 10% and Amazon at 9%

- Netflix had 9 of the top 10 most-streamed pieces of programming from March 9–15, per Nielsen, including “Spenser Confidential,” followed by “The Office” in the top two spots

In response to at-home viewing changes, many movie studios fast-tracked their digital downloads and introduced streaming options for movies like Frozen II and the Invisible Man. Will more consumers opt for at-home viewing over visiting theaters post-pandemic?

Global mobile game downloads were up 20% in Q1 2020 compared to the same period last year to the tune of 13 billion new downloads, reports AppAnnie. Consumers spent over $16.7 billion on mobile gaming in the recent quarter, a 5% increase from the previous quarter. Beyond grocery and gaming apps, video conferencing also saw a surge in downloads with Zoom, Google Hangouts, HouseParty and Microsoft Teams leading the way.

Source: AppAnnie.

Changes in future spending

According to GlobalWebIndex, globally, almost 40% of people say they will buy major purchases they have delayed only when the outbreak begins to decrease or is over in their country, while almost 20% say they will wait until the outbreak subsides or is completely over globally.

The top income groups are those open to making their purchases once the national situation begins to improve. Flights (26%) and vacations (41%) are the most likely to have been delayed, but around 15% report delaying purchases of luxury items, technology devices and home appliances and devices.

Of all the age groups, Gen Z is the group most likely to be delaying purchases in several categories, which can most likely be attributed to their lower average income levels. 20%+ of them say they are delaying buying technology devices.

16

18

22

24

Source: GlobalWebIndex. March 16 – 20, 2020. Base: 12,845 internet users aged 16 – 64.

Changes in the economy

A Morgan Stanley report projects American gross domestic product to fall at an annual rate of 30.1% in April-June, with unemployment averaging 12.8% over the period. Goldman Sachs is projecting a 24% annualized drop in output in the next quarter.

If we look to the SARS outbreak for comparison, it was believed to have cost about US$40 billion, and economist Warwick McKibbin says COVID-19 could cost three or four times as much (Source: Institute of Medicine, Learning From SARS 2003).

The Labor Department reported that unemployment claims in the US rose to a record to 3.28 million for the week ending March 20, shattering previous record highs from the Great Recession peak. The following week, 6.6 million Americans filed for unemployment – the highest number of new unemployment claims in US history.

The ripple effects of what is happening will be far and wide. There’s no way to predict exactly what they may be, so we must be nimble in our approach. We must be ready for what’s next, even if we don’t know what that is.

Changes in marketing

Many brands have pulled back their marketing significantly, if not completely. That may well be the best approach, especially as we grapple with the spread of the virus and get testing or treatment underway across the country. Unfortunately, what we know about brands that go dark during recessions is that they suffer a significant brand metric decline, according to Millward Brown. 60% of brands who went dark during the 2008 recession saw a decline in at least one key brand metric causing customer relationships to suffer.

As outlined by the IPA:

“The data went on to illustrate the increased risk of failure when communications expenditure was then resumed after the end of the downturn. Further data was presented showing a strong relationship between the level of risk of loss of share and the key expenditure metric: share of voice (SOV) minus share of market (SOM), where share of voice is defined as a brand’s share of total category communications expenditure.”

Brands with equity and awareness can continue to benefit from their marketing investment made over the previous few years, which can mitigate short-term business effects. In scenarios where budgets were halved for one year and then returned to usual levels, sales recovery to pre-cut levels took five and three years, respectively. As marketers, we must look at our plans in the long term and with as much efficiency as possible.

GlobalWebIndex asked people if brands should carry on advertising as normal, just over a third agreed and over a quarter disagreed. Approval is led by Australia, Brazil, Italy and the Philippines at over 50%. Disapproval peaks in Germany at 60%, followed by France at 40%.

Globally, people are most in favor of brands responding to the outbreak by providing flexible payment terms (83%), offering free services (81%), closing non-essential stores (79%) and helping to produce essential supplies (67%)-all scoring significantly more than the 37% who think they should carry on advertising as normal.

One thing’s for sure, while we may not know “normal” for some time, we can arm ourselves with as much information as we can to make the best decisions for the moment.